Tax Slabs for AY 2024-25

The Finance Act 2023 has amended the provisions of Section 115BAC w.e.f AY 2024-25 to

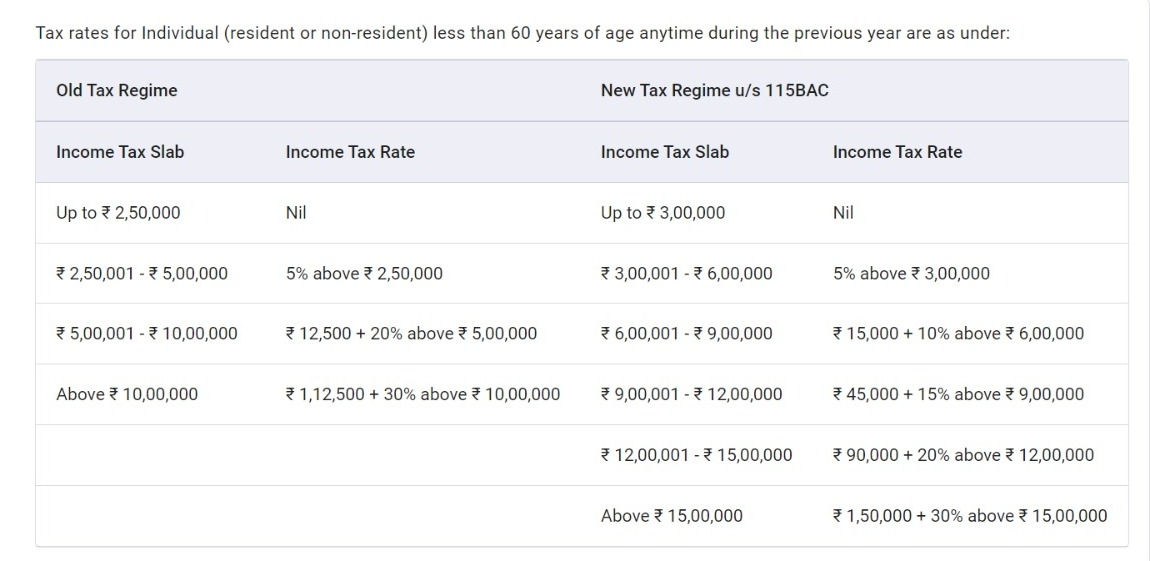

make new tax regime the default tax regime for the assessee being an Individual, HUF, AOP

(not being co-operative societies), BOI or Artificial Juridical Person. However, the eligible taxpayers have the option to opt out of new tax regime and choose to be taxed under old tax regime. The old tax regime refers to the system of income tax calculation and slabs that existed before the introduction of the new tax regime. In the old tax

regime, taxpayers have the option to claim various tax deductions and exemptions.

In case of "non-business cases", option to choose the regime can be exercised every year

directly in the ITR to be filed on or before the due date specified under section 139(1).

In case of eligible taxpayers having income from business and profession and wants to opt out of new tax regime, the assessee would be required to furnish Form-10-IEA on or before the due date u/s 139(1) for furnishing the return of income. Also, for the purpose of withdrawal of such option i.e. opting out of old tax regime shall also be done by way of furnishing Form No.10-IEA.

However, in case of eligible taxpayers having income from business and profession option to switch to old tax regime and withdraw the option in any subsequent AY is available only once in lifetime.

|

||||||||||||||||||||||||||||||||

|

Tax rates for Individual (resident or non-resident), 60 years or more but less than 80 years of age anytime during the previous year are as under:

|

|||||||||||||||||||||||||||||||||

|

Tax rates for Individual (resident or non-resident) 80 years of age or more anytime during the previous year are as under:

|

|||||||||||||||||||||||||||||||||

|

Note: 1. The rates of Surcharge under the two tax regimes are as under:

Note: The enhanced surcharge of 25% & 37%, as the case may be, is not levied, from income chargeable to tax under sections 111A, 112, 112A and Dividend Income. Hence, the maximum rate of surcharge on tax payable on such incomes shall be 15%, except when the income is taxable under section 115A, 115AB, 115AC, 115ACA and 115E. 2. Rebate u/s 87A: Resident Individuals are also eligible for a Rebate of up to 100% of income tax subject to a maximum limit depending on tax regimes as under:

3. The rate of Health & Education cess remains same in both the regimes. |

|||||||||||||||||||||||||||||||