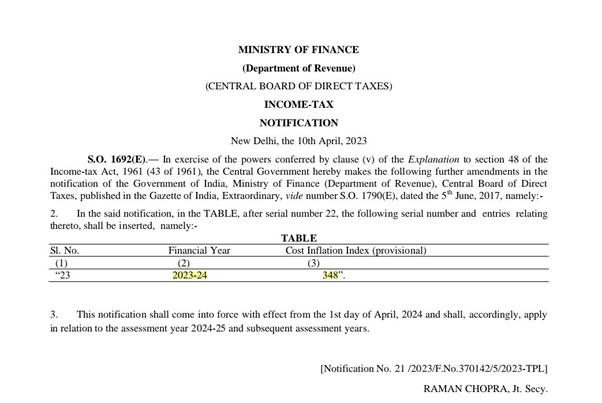

CBDT Notified Cost Inflation Index FY 2023-24 (AY 2024-25) is 348

The Government of India, Ministry of Finance (Department of Revenue), Central Board of Direct Taxes published in the Gazette of India, Notification No. 21 /2023/F.No.370142/5/2023-TPL, Dated 10th April 2023 the Cost Inflation Index for Financial Year 2023-24 which is 348.

The cost of inflation index (CII) has been notified by the Central Government every year by notification in the Official Gazette. The cost of acquisition/improvement will, thus, be indexed with reference to the rate applicable for the relevant year. The Cost of Inflation Index is mainly used to compute Long term capital gain.

The New Cost of Inflation Index (CII) comes into force w.e.f. 01-04-2018

|

Financial Year 2023-24 2022-23 |

Cost Inflation Index 348 331 |

|

2021-22 |

317 |

|

2020-21 |

301 |

|

2019-20 |

289 |

|

2018-19 |

280 |

|

2017-18 |

272 |

|

2016-17 |

264 |

|

2015-16 |

254 |

|

2014-15 |

240 |

|

2013-14 |

220 |

|

2012-13 |

200 |

|

2011-12 |

184 |

|

2010-11 |

167 |

|

2009-10 |

148 |

|

2008-09 |

137 |

|

2007-08 |

129 |

|

2006-07 |

122 |

|

2005-06 |

117 |

|

2004-05 |

113 |

|

2003-04 |

109 |

|

2002-03 |

105 |

|

2001-02 |

100 |

Old Cost Inflation Index effective for the period up to 31-03-2017 i.e. Financial Year 2016-17.

|

Financial Year |

Cost of Inflation Index (CII) |

|

2016 – 17 |

1125 |

|

2015 – 16 |

1081 |

|

2014 – 15 |

1024 |

|

2013 – 14 |

939 |

|

2013 – 14 |

939 |

|

2012 – 13 |

852 |

|

2011 – 12 |

785 |

|

2010 – 11 |

711 |

|

2009 – 10 |

632 |

|

2008 – 09 |

582 |

|

2007 – 08 |

551 |

|

2006 – 07 |

519 |

|

2005 – 06 |

497 |

|

2004 – 05 |

480 |

|

2003 – 04 |

463 |

|

2002 – 03 |

447 |

|

2001 – 02 |

426 |

|

2000 – 01 |

406 |

|

1999 – 00 |

389 |

|

1998 – 99 |

351 |

|

1997 – 98 |

331 |

|

1996 – 97 |

305 |

|

1995 – 96 |

281 |

|

1994 – 95 |

259 |

|

1993 – 94 |

244 |

|

1992 – 93 |

223 |

|

1991 – 92 |

199 |

|

1990 – 91 |

182 |

|

1989 – 90 |

172 |

|

1988 – 89 |

161 |

|

1987 – 88 |

150 |

|

1986 – 87 |

140 |

|

1985 – 86 |

133 |

|

1984 – 85 |

125 |

|

1983 – 84 |

116 |

|

1982 – 83 |

109 |

|

1981 – 82 |

100 |

FAQ on Cost Inflation Index in India

Q.1 What is the cost inflation index?

The cost inflation index (CII) is fixed by the Government of India in its official Gazette to measure inflation. The Cost Inflation Index is mainly used in the computation of long-term capital gains with regard to the sale of assets.

Thus, indexation helps reflect the actual value of the asset at present market rates, taking into account the erosion of value due to inflation. It may be noted that if the asset was purchased before 1981, the cost inflation index of the year 1981 i.e. 100 must be taken into consideration.

Q.2 How to use Cost Inflation Index (CII) in the determination of the Purchase Price of Assets sold?

The Formula is as under:

Purchase Price of Asset Sold x [CII for the year the asset was transferred or sold ÷ CII for the year the asset was acquired or bought]

Illustration:- Indexed Cost of Acquisition=(Cost of Acquisition/Cost of Inflation Index (CII) for the year in which the asset was first held by the assessee OR FY 2001-02, whichever is later)* Cost of the Inflation Index (CII) for the year in which the asset was sold or transferred.

Let us assume that you purchased the property in FY 2005-06 at Rs.60 lakh and sold the same in FY 2017-18 at Rs.1.8 Cr. Now the indexed cost of acquisition will be as per the above formula i.e.

Indexed Cost of Acquisition = (Rs.60 lakh/117)*272=Rs.1,39,48,718. So the Long Term Capital Gain=Selling Price-Indexed Cost of buying property=Rs. 40,51,282.

(Note-As per the below Cost of Inflation Index (CII), the CII rate for FY 2017-18 is 272, and for FY 2005-06, it is 117).

However, if you do not consider the indexed cost, then in plain the gain may be said as Rs.1.2Cr (Rs.1.8 Cr-Rs.60 Lakh). But in the case of taxation, the LTCG on capital assets will be after adjusting the cost of buying to inflation or the Cost of Inflation Index (CII).

Hope you understood the concept and importance of the Cost of Inflation Index (CII).