Set Off and Carry Forward of Losses

Profit and losses are two sides of a coin. Losses, of course, are hard to digest. However, the Income-tax law in India does provide taxpayers some benefits of incurring losses too. The law contains provisions for set-off and carry forward of losses which are discussed in detail in this article.

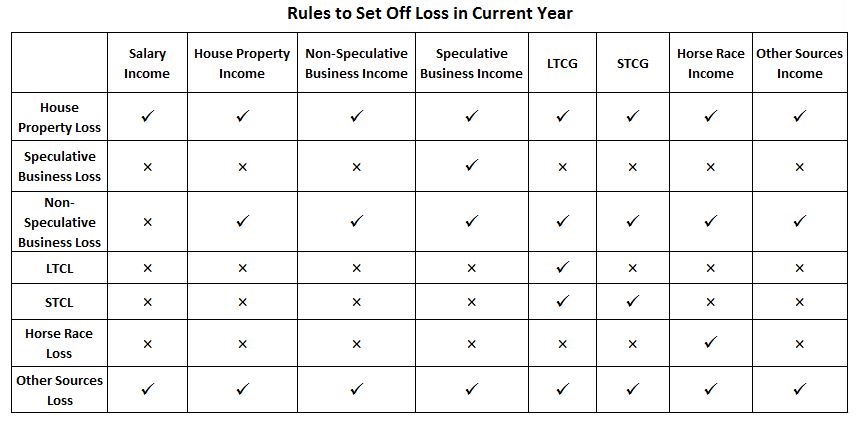

Set off of losses

Set off of losses means adjusting the losses against the profit or income of that particular year. Losses that are not set off against income in the same year can be carried forward to the subsequent years for set off against income of those years. A set-off could be an intra-head set-off or an inter-head set-off.

Intra-head Set Off

The losses from one source of income can be set off against income from another source under the same head of income.

For eg: Loss from Business A can be set off against profit from Business B, where Business A is one source and Business B is another source and the common head of income is “Business”.

Exceptions to an intra-head set off:

- Losses from a Speculative business will only be set off against the profit of the speculative business. One cannot adjust the losses of speculative business with the income from any other business or profession.

- Loss from an activity of owning and maintaining race-horses will be set off only against the profit from an activity of owning and maintaining race-horses.

- Long-term capital loss will only be adjusted towards long-term capital gains. However, a short-term capital loss can be set off against both long-term capital gains and short-term capital gain.

- Losses from a specified business will be set off only against profit of specified businesses. But the losses from any other businesses or profession can be set off against profits from the specified businesses.

Inter-head Set Off

After the intra-head adjustments, the taxpayers can set off remaining losses against income from other heads.

Examples :- Loss from house property can be set off against salary income.

Few more such instances of an inter-head set off of losses:

- Loss from House property can be set off against income under any head

- Business loss other than speculative business can be set off against any head of income except income from salary.

Following losses can’t be set off against any other head of income:

- Speculative Business loss

- Specified business loss

- Capital Losses

- Losses from an activity of owning and maintaining race-horses

Carry forward of losses

After making the appropriate and permissible intra-head and inter-head adjustments, there could still be unadjusted losses. These unadjusted losses can be carried forward to future years for adjustments against income of these years. The rules as regards carry forward differ slightly for different heads of income.

Losses from House Property:-

- Can be carry forward up to next 8 assessment years from the assessment year in which the loss was incurred

- Can be adjusted only against Income from house property

- Can be carried forward even if the return of income for the loss year is belatedly filed.

Losses from Non-speculative Business (Regular Business) Loss:-

- Can be carry forward up to next 8 assessment years from the assessment year in which the loss was incurred

- Can be adjusted only against Income from business or profession

- Not necessary to continue the business at the time of set off in future years

- Cannot be carried forward if the return is not filed within the original due date.

Speculative Business Loss

- Can be carry forward up to next 4 assessment years from the assessment year in which the loss was incurred

- Can be adjusted only against Income from speculative business

- Cannot be carried forward if the return is not filed within the original due date.

- Not necessary to continue the business at the time of set off in future years

Specified Business Loss under 35AD

- No time limit to carry forward the losses from the specified business under 35AD

- Not necessary to continue the business at the time of set off in future years

- Cannot be carried forward if the return is not filed within the original due date

- Can be adjusted only against Income from specified business under 35AD

Capital Losses

- Can be carry forward up to next 8 assessment years from the assessment year in which the loss was incurred

- Long-term capital losses can be adjusted only against long-term capital gains.

- Short-term capital losses can be set off against long-term capital gains as well as short-term capital gains

- Cannot be carried forward if the return is not filed within the original due date

Losses from owning and maintaining race-horses

- Can be carry forward up to next 4 assessment years from the assessment year in which the loss was incurred

- Cannot be carried forward if the return is not filed within the original due date

- Can only be set off against income from owning and maintaining race-horses only

Summary Table of Set Off & Carry forward Of Losses :-

|

Section |

Losses to be carried forward |

Can be set off against Income |

Time up to which losses can be carried forward |

Mandatory to file return in the year of loss |

|

32(2) |

Unabsorbed depreciation |

Any income (other than salary) |

No time limit |

No |

|

71B |

Loss from House property |

Income from house property |

8 years |

No |

|

72 |

Loss from Normal business |

Income from business |

8 years |

Yes |

|

73 |

Loss from speculative business |

Income from speculative business |

4 years |

Yes

|

|

73A |

Loss from specified business |

Income from specified business |

No time limit |

Yes |

|

74 |

Short term capital loss (STCL)

|

Short term capital gain (STCG) & long term capital gain (LTCG) |

8 years |

Yes |

|

74 |

Long term capital loss (LTCL) |

(LTCG) |

8 years |

Yes |

|

74A |

Loss from owning and maintaining horse races |

Income from owning and maintaining horse races |

4 years |

Yes |