What is a PAN Card?

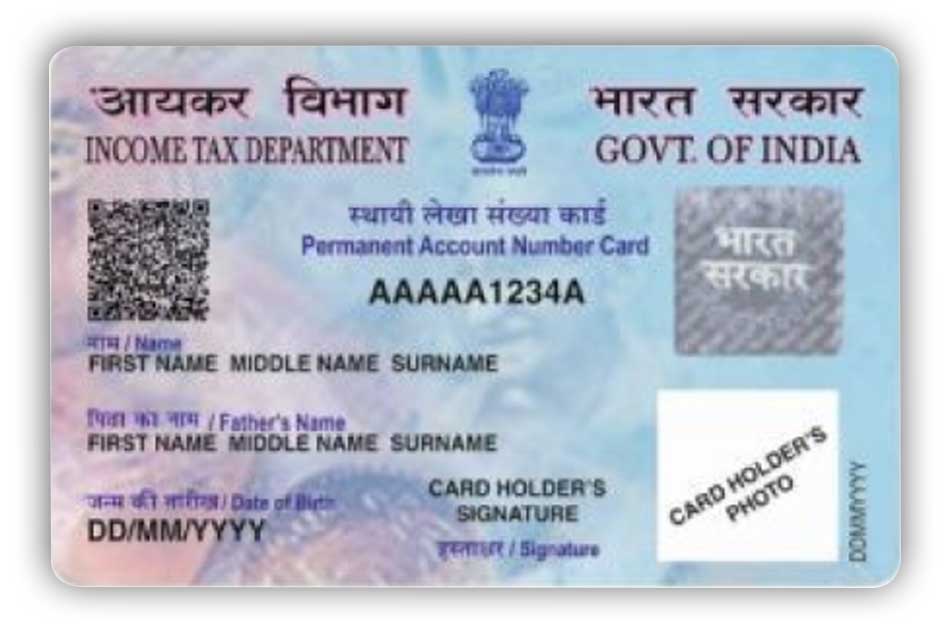

As we all know PAN (Permanent Account Number) Card is an identification proof issued by the Income Tax Department. It contains the following 5 basic information along with your photograph:

- Your Full Name

- Father's Name (Mother's name in case of a single parent)

- Date of Birth

- PAN Number which is a ten-digit alphanumeric unique code.

- Your Signature

Through your PAN number, the Income Tax Department keeps an eye on all your transactions that requires your PAN Card like depositing money in your bank account over Rs 50,000 at one time, buying goods and services more than Rs 2 Lakh etc.

What is significance of 4th letter in the PAN card number?

The 4th letter stands for any of the following:-

- "P" for Individual

- "C" for Company

- "H" for Hindu Undivided Family (HUF)

- "A" for Association of Persons (AOP)

- "B" for Body of Individuals (BOI)

- "G" for Government Agency

- "J" for Artificial Juridical Person

- "L" for Local Authority

- "E" for Limited Liability Partnership

- "F" for Firm

- "T" for Trust

How does the 5th digit depict the last name of the holder?

In case of an individual, the 5th digit is the first letter of the last name / surname.

For example, Mr. Vishal Meena applied for a PAN, then the 5th digit of her PAN will be "M".

But, in case of a non-individual, the 5th digit shall denote the first character of the PAN holder's name. Let's say, VR Soft Tech. Pvt Ltd applied for a PAN, then the 5th digit of the unique number allotted to it will be "V".

Why should I need a PAN Card?

PAN number basically creates your identity in front of Income Tax Department. The department doesn't identify you by your name or father's name but by your unique 10-digit number mentioned on your PAN Card. From filing returns to paying taxes to getting refunds and for all the communications with the Income Tax Department, PAN is a pre-requisite. The Income Tax Department mandates you to have PAN Card in the following circumstances-

- When you are liable to pay income tax i.e. if your income exceeds Rs. 2,50,000/- in a financial year before deduction U/s 80C & other Deductions;

- When TDS is deducted from your income;

- Where you are a professional or businessman and your gross receipts exceed Rs. 5 lakhs in a year;

- Where you are an importer or exporter, who is required to obtain Import Export Code;

- Where you are a charitable trust who is required to furnish return under Section 139(4A); and

- When you intend to enter into any specified financial transactions in which quoting of PAN is mandatory

Well, not only the Income Tax Department but other institutions also require quoting of pan mandatorily in the following specified transactions:

1. Opening:

- A New Bank Account;

- A new DEMAT Account

2. Applying for:

- A credit card or debit card;

3. Payments to:

- Life insurance premium when the total amount paid during the year is exceeds Rs.50000

- Mutual fund / company / RBI for acquiring units / debentures / bonds issued by it when the total amount paid during the year exceeds Rs.50000.

4. Sale or purchase of :

- Immovable property for an amount exceeding Rs. 10,00,000

- Securities or shares for an amount exceeding Rs. 1 lakh per transaction;

- Motor vehicle or vehicle other than two- wheeled vehicles (inclusive of any detachable side car having an extra wheel);

- Goods and services of any nature other than those mentioned above for an amount exceeding Rs. 2 lakhs per transaction.

5. Time deposits with a banking company, post office, Nidhi Company or any NBFC of amount exceeding Rs. 50,000 in a day or Rs. 5 lakhs in a year.

6. Payments in cash:

- To hotels and restaurants for bills exceeding Rs. 50,000;

- For purchase of bank drafts / pay orders / banker's cheques from a banking company or a co-operative bank an amount exceeding Rs. 50,000 during a day

7. Cash deposit of Rs. 50,000 or more with any bank during one day;

8. Payment for travel to any foreign country or for purchase of foreign currency for an amount exceeding Rs. 50,000;

If you are a non - resident, then you can avail the following exemptions in relation to quoting of PAN:

- Applying for a credit card or debit card;

- Payments in cash to hotels and restaurants for bills exceeding Rs. 50,000;

- Payment in connection with travel to any foreign country or for purchase of foreign currency for an amount exceeding Rs. 50,000;

- Payment in cash for an amount exceeding Rs. 50,000 during any one day for purchase of bank drafts / pay orders / banker's cheques from a banking company or a co-operative bank;

- Payment of an amount exceeding Rs. 50,000/- to RBI for acquiring the bonds issued by it;

- Sale or purchase of goods and services of any nature other than those mentioned above exceeding an amount of Rs. 2 lakhs per transaction;

- Payment in cash or by way of a bank draft / pay order / banker's cheque of an amount exceeding Rs. 50,000 in a financial year for one or more pre-paid

- Payment instruments issued by RBI to a banking company or a co-operative bank or to any other company or institution.

What if my minor child enters in the above mentioned transactions?

If any minor enters in these specified transactions, then he can quote PAN of his parents or guardian.But when the income of the minor child exceeds Rs 2,50,000 which is chargeable to Income Tax then he cannot quote PAN of his parents or guardian and will be required to have his own PAN card.

What happens when I enter into such above mentioned transactions without having PAN card?

In case you don't have a PAN number and you enter into any of the above mentioned transactions, then you are required to file a declaration in Form No. 60. A Form 60 is just a form containing basic details such as your name, the transaction you are entering into, any return if filed and the reason for not having a PAN. Also, a valid proof of address is to be attached with Form 60.

How do I apply for a PAN?

You are required to fill the prescribed application form along with the required attachments either offline or online through NSDL or UTI

What are the types of PAN application form?

Following are the different types of application forms:

- Form 49A – Application for allotment of PAN to be filled by the Indian citizens / Application of request for new PAN Card or / and changes or corrections in PAN

- Form 49AA - Application for allotment of PAN to be filled by foreign citizens.

- In case of a company which has not been registered under the Companies Act, 2013, the application for allotment of Permanent Account Number (PAN) may be made in Form No. SPICe+.

How much time will it take to receive my PAN card?

Generally, it takes about 10 - 15 business days for your PAN card to reach at the address provided by you in the details.

Can I have two PAN cards?

No person can hold two PAN's and thus, if you have more than one PAN, surrender it immediately to the income tax department. In fact, a penalty of Rs. 10,000 can be imposed on you in such a case.

Can I apply a PAN on behalf of someone else?

Yes, you can apply for a PAN on behalf of the following persons:

- A minor

- A lunatic or mentally unstable person;

- A deceased person; or

- Such other persons who are required to be represented by an Authorized Representative.

I have lost my PAN card, now?

In case, you lost your PAN card, you need to apply for re-issuing or re-printing of your PAN card by submitting a valid ID, address and DOB proof along with an attested photocopy of old PAN card. Remember, do not apply for a new PAN card altogether.

My address has changed, do I need to apply for a new PAN card?

No. A change in address is just a change in your jurisdiction and assessing officer, and no application for a new PAN is required in such a case. Only, the change in address is required to be intimated to the income tax department for successful updation of their database for future correspondence.

What happens in case of any contravention relating to PAN?

In case, if you contravene any provision relating to Section 139A i.e. PAN, then you will be liable for a penalty amounting to Rs. 10,000/- per default u/s 272B of the Income Tax Act, 1961. The contraventions can be any of the following:

- Not obtaining a PAN when you are liable to obtain one;

- Knowingly quoting an incorrect PAN in any documents;

- Intimating an incorrect PAN to the person who is liable to deduct tax at source (TDS);

- Intimating an incorrect PAN to the person who is liable to collect tax at source (TCS);

- Obtaining two PAN's.